The International Accounting Standards Board (“IASB”) has published the Exposure Draft on Business Combinations — Disclosures, Goodwill and Impairment (the “Exposure Draft”) in March 2024,

proposing changes to IFRS 3 and IAS 36 to improve the information provide to investors in order to help investors better assess management’s decision to make an acquisition and the performance of that acquisition. Companies should pay attention to the potential impact of the Exposure Draft and ensure their compliance with the latest rules and disclosure requirements.

The International Accounting Standards Board (“IASB”) has published the Exposure Draft Business

Combinations—Disclosures, Goodwill and Impairment (the “Exposure Draft”) in March 2024. The Exposure

Draft considers three major topics, including (1) improving disclosures about acquisitions, (2) improving

effectiveness of impairment test, and (3) reducing the cost and complexity of the impairment test.

As an experienced independent valuation and advisory firm that has been consistently monitoring the

development of accounting standards related to valuation matters, AVISTA has outlined the key points in

the Exposure Draft

Improving Disclosures about Acquisitions

In response to investors’ concerns about receiving insufficient information to understand the

management’s initial objectives for an acquisition and the subsequent performance of that acquisition, the IASB proposed changes to IFRS 3 and IAS 36, allowing investors to get access to better information and to directly assess the reasonableness of the acquisition price and the accomplishment of the acquisition.

To avoid disclosure overload, certain proposed disclosure requirements only apply to strategic

acquisitions, being a subset of material acquisitions and is defined based on either (1) qualitative

thresholds – the acquisition results in a company entering a new major line of business or geographical

locations; or (2) quantitative thresholds – any one of revenue, operating profit and assets of the acquired

business constitutes at least 10% of the acquirer’s corresponding amounts.

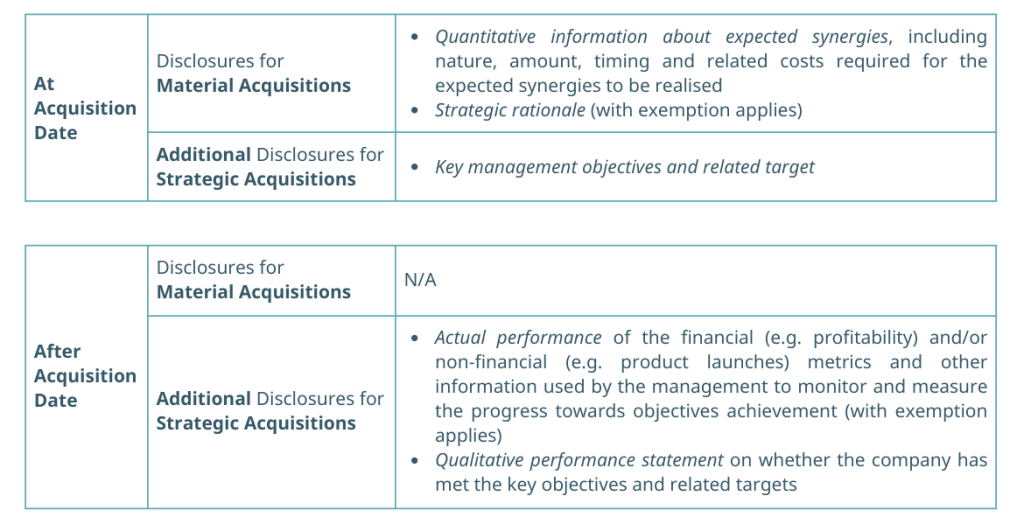

The below table summarised the relevant proposed disclosure requirements

Improving Effectiveness of Impairment Test

The IASB aims to enhance the effectiveness of impairment test for goodwill by addressing investors’

concerns regarding delays in recognizing impairment losses. These concerns primarily stem from (1)

management over-optimism in cash flow forecasts; and (2) the shielding effect, where acquired goodwill

may be shielded from impairment by the headroom of the combined business.

To reduce management over-optimism, the IASB proposed disclosure requirements to indicate the

reportable segment where the cash-generating unit(s) containing goodwill is included. This disclosure

allows users to compare the assumptions used in the impairment testing to the performance of the

respective reportable segments for assessing their reasonableness and mitigating management over

optimism.

Despite some level of shielding is inevitable, the IASB proposed the provision of additional guidance on the allocation of goodwill to the cash-generating unit(s), such as specifying the highest level to which a

company can allocate goodwill and clarifying that this level is not a default, aiming to reduce shielding.

Reducing the Cost and Complexity of the Impairment Test

The IASB proposed two reliefs to reduce the cost and complexity of the impairment test, including (1)

removing the restriction on including uncommitted future restructuring and asset enhancement cash flows; and (2) removing the requirement to use a pre-tax discount rate to calculate value in use. Removing these restrictions would align the inputs used in the impairment test more closely with the information used by management, ultimately providing investors with more relevant information.