In October 2023, the Stock Exchange of Hong Kong Limited issued a guidance letter on the “Disclosure of the Basis of Consideration and Business Valuations in Notifiable Transactions”.

The guidance letter emphasizes the need for listed companies to provide adequate explanation of the basis for determining the consideration of the transaction by disclosing sufficient and objective information in the disclosure documents, and provides guidance on the recommended disclosures.

In a financial landscape where precision and transparency are paramount, the Stock Exchange of Hong

Kong Limited (the “HKEx”) has published a guidance letter (the “Guidance Letter”) on 20 October 2023 to

address the concerns for the fairness and reasonableness of the terms of a transaction. In particular, the

Guidance Letter emphasizes the need for listed companies to provide adequate explanation of the basis for determining the consideration of the transaction by disclosing sufficient and objective information with quantitative inputs and analysis to substantiate how the consideration was arrived at. The disclosure should be specific and not to be overly general and simplistic, allowing shareholders to understand how the valued amount was determined, and so as the consideration. The Guidance Letter provides guidance on the recommended disclosures and is divided into two sections. One for the disclosures in a business valuation report and the other for the transactions where no independent valuation is conducted.

Recommended Disclosures of Business Valuation Report

Under the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (the

“Listing Rules”), when an issuer conducts an acquisition or disposal that constitutes a notifiable transaction and where the consideration of the transaction is determined with reference to an independent business valuation of the subject company (the “Target”), the disclosure document should contain the valuation report of the Target or summary of the valuer’s view and analysis, and all material factors considered in the valuation report, including at least the information about the effective valuation date, valuation approaches, scope and limitation of work, principal assumptions and key information adopted, conclusion of value, as well as the identity, qualification and independence of the valuer.

In the appraisal of the value of the Target, different valuation approaches may be adopted. Regardless of

which approach is adopted, the reasons for the selection and the key inputs and assumptions need to be

clearly disclosed, to the extent necessary for the shareholders to understand the valuation.

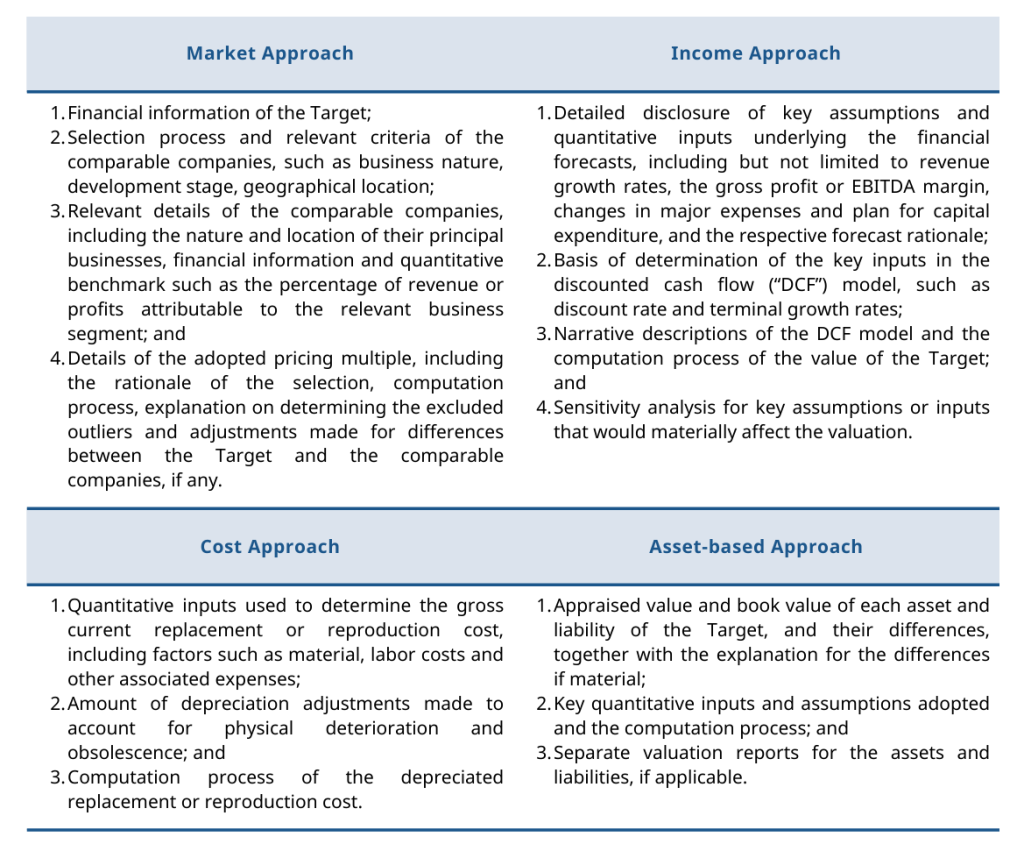

The following summarized the recommended disclosures of the key inputs and assumptions for different

approaches by the Guidance Letter.

Transaction where there is no Independent Valuation

As suggested in the Guidance Letter, regardless of whether an independent valuation is obtained for a

notifiable transaction, the issuer has to provide an adequate explanation of the basis for determining the

consideration. Therefore, if the issuer does not engage an independent valuer to perform the business

valuation, one should also adopt appropriate valuation methodology to assess the value of the Target, and the corresponding basis of determination of the consideration should be sufficiently documented in the disclosure documents in accordance with the recommended disclosures by the Guidance Letter.

How AVISTA can Help

While business valuation plays an indispensable role in an acquisition or a disposable transaction, the

Listing Rules currently do not impose strict requirements for independent valuation for a notifiable

transaction. On the other hand, as stressed in the guidance note on directors’ duties in the context of

valuations in corporate transactions issued by the Securities and Futures Commission (the “SFC”) in May

2017, directors are responsible for determining whether the terms of the transaction, including the

consideration to be paid, are fair and reasonable. Directors should therefore consider the need for a

valuation to be conducted by an independent professional valuer if the directors do not themselves possess sufficient experience or expertise in either the field of business to which the asset or the Target belongs or in valuation as a whole. An independent professional valuer could aid the directors in assessing the reasonableness of the consideration by performing thorough analysis, which include but not limited to understanding the business of the Target, analyzing its financial performance, performing market research of the industry where the Target is operating, etc.

As a leading professional business valuation firm in Hong Kong, AVISTA has extensive financial knowledge

and experience in business valuation for different industries. Our experienced professionals come from

globally renowned valuation firms, consulting firms and international accounting firms with qualifications

such as CPA, CFA, CPV, FRM and MRICS etc. Our valuation experts are ready to advise you on how to ensure compliance with regulators’ stringent rules and disclosure requirements when implementing business decisions and strategies.

For further information or enquiries, please feel free to contact us.