Taking reference to compliance development of other stock exchanges, previous consultations, and years of corporate governance reports review results, HKEX would like to introduce a series of listing rules amendments.

A consultation paper has been published in June2024 to collect market’s feedback. According to the consultation paper, except for the proposed amendment in relation to long serving independent non-executive director(“INED”) and overboarding with a three-year transition period starting January 2028, other amendments will take effect since January 2025. Most amendments are newly introduced practices, and thus companies are recommended to arrange resources promptly to prepare for the new compliance requirements by 2025.

The Hong Kong Stock Exchange (“HKEX”) is committed to enhancing corporate governance performance to improve the quality of listed companies in Hong Kong, thereby strengthening investor confidence to Hong Kong’s capital market. Taking reference to compliance development of other stock exchanges, previous consultations, and years of corporate governance reports review results, HKEX would like to introduce a series of listing rules amendments. A consultation paper has been published in June

2024 to collect market’s feedback. According to the consultation paper, except for the proposed amendment in relation to long serving independent non-executive director (“INED”) and overboarding with a three-year transition period starting January 2028, other amendments will take effect since January 2025. Most amendments are newly introduced practices, and thus companies are recommended to arrange resources promptly to prepare for the new compliance requirements by 2025.

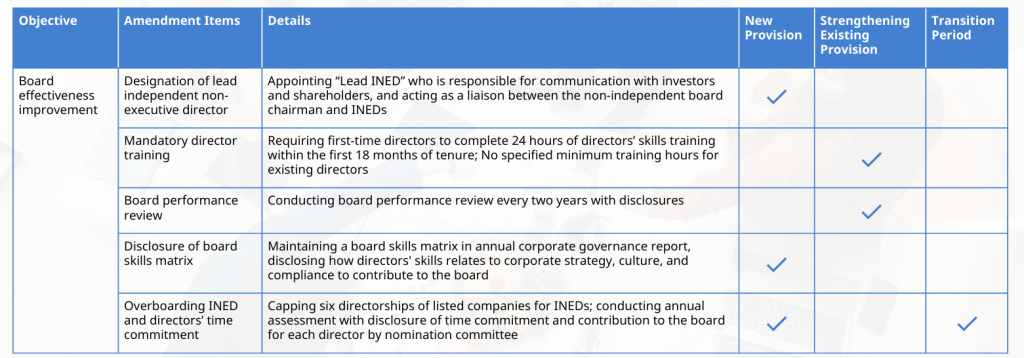

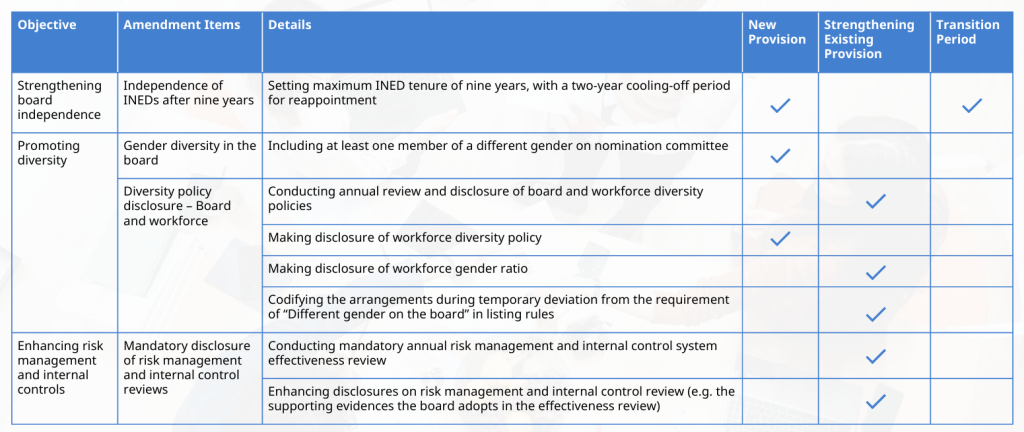

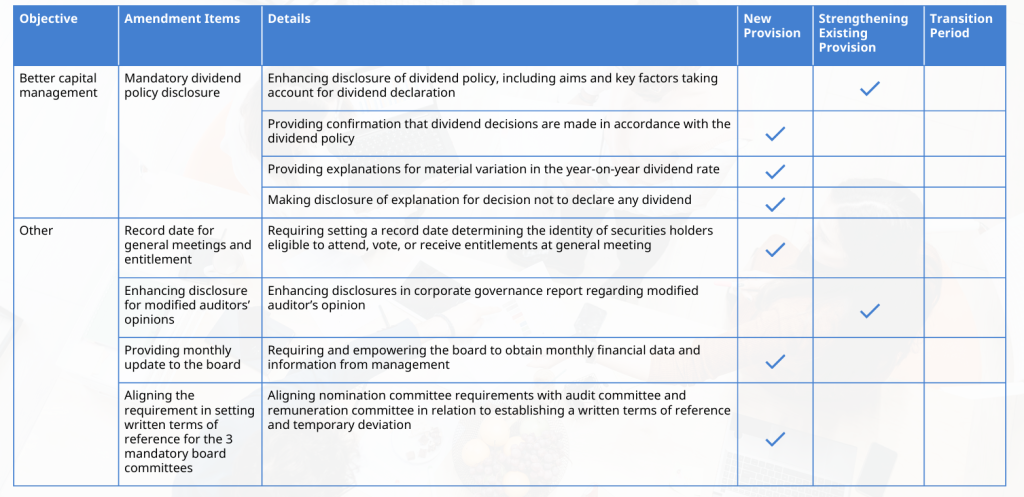

For clarity, we have summarized the proposed amendments in below table

Our years of experience in corporate governance advisory and deep understanding of the governance structures and operation processes adopted in listed companies in Hong Kong, Avista can provide customized services to assist listed companies in meeting the new compliance requirements.